“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with hardly a fraction in reserve.”

What does the macroeconomics of Bitcoins look like? This is a question worth pondering over as it highlights some of the salient features of money, currencies, and their valuations but in a much simpler environment, i.e., without the distortions wrought by the world’s central banks through their currency interventions. So let’s imagine taking a trip to an alternate planet in the financial universe where all goods and services are denominated in fiat currencies, i.e., currencies endorsed by the governments on the planet, but which can be also be easily bought and sold in Bitcoins as an alternative. For ease of exposition, we shall refer to this make-believe world as simply “Planet Bitcoin.”

On Planet Bitcoin, we can identify four representative classes of inhabitants: (i) The Users, who choose to use Bitcoins as a medium of exchange whenever and wherever they could even though the unit of accounts for all goods and services are in fiat currencies; (ii) The Dealers, who trade in Bitcoins so as to facilitate currency exchanges between Bitcoins and fiat currencies; (iii) The Miners, who create Bitcoins and put them into circulation; and (iv) The Hoarders, who hold onto Bitcoins as an investment and view Bitcoins as a good store of value.

Meet the Representative Inhabitants of Planet Bitcoin: User, Dealer, Miner, and Hoarder.

Let’s posit that the law of supply and demand works just as well on Planet Bitcoin as on planet Earth, and that the supply and demand of Bitcoins itself is no exception. The key is in finding the right metrics. We know that Bitcoins, by definition, has a maximum money supply that is capped at 21 million Bitcoins. As of today, over 14 million Bitcoins have been issued and are in circulation, constituting a Bitcoin market capitalization of over 3 billion USD at current exchange rate of approximately 225 USD per Bitcoin. In recent months, the Bitcoin economy as measured by its estimated daily transaction volume has been fluctuating around 150,000 Bitcoins, representing about 40 million USD worth of goods and services in 100,000 transactions daily. In addition, the daily exchange trade volume of Bitcoins fluctuates around 5,000 to 8,000 Bitcoins representing about 2 million USD of daily exchange trading volume.

We hope to understand the macroeconomics of Bitcoins using the following metrics as proxies for aggregate supply and demand of Bitcoins: (1) Transaction Volume, (2) Trade Volume, (3) Transaction Number, and (4) Effective Money Supply. In particular, how would interactions among the Users, Dealers, Miners and Hoarders on Planet Bitcoin affect these metrics? More importantly, what is their net effect on the valuation of Bitcoin?

To provide a starting point for discussion, we shall presently invoke the following equation of exchange as applied to Bitcoin as a basic framework for our analysis:

M V = P Q

where, for a given period on Planet Bitcoin,

- M is the effective amount of Bitcoins in circulation (i.e., effective money supply).

- V is the velocity of money, or how often a Bitcoin is transacted (i.e., per Bitcoin transaction number).

- P is the price level as measured in Bitcoins (i.e., inverse of Bitcoin valuation).

- Q is the fiat money sum of all goods and services transacted with Bitcoins (i.e., transaction volume).

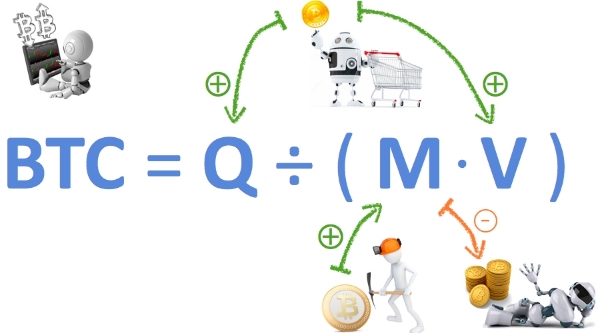

We can consider the price level as the inverse of Bitcoin valuation, i.e., with respect to some fiat currency. After all, higher Bitcoin valuation means lower prices and vice versa. Rearranging the equation of exchange slightly, we arrive at the following expression for valuation of Bitcoin (BTC):

BTC = 1/P = Q/(M V)

Notice that fiat money is now considered real and Bitcoins nominal in the equation of exchange. It is now easier to see how the different activities of Users, Miners, and Hoarders interact together on Planet Bitcoin as described by this Bitcoin valuation formula as experienced by the Dealers:

Causal links showing how activities by User, Miner, and Hoarder affect key metrics in the valuation formula positively or negatively as seen by Dealer, whose trading activities have no net effect on Bitcoin valuation.

It becomes clear that increased demand for Bitcoins by Hoarders and Users raises Bitcoin valuation by reducing its effective money supply in two ways: (1) hoarding a Bitcoin over a longer term effectively takes it out of circulation for an extended period of time; and (2) transacting with a Bitcoin increases utilization of the money supply by making that Bitcoin temporarily unavailable for use by others for a brief period surrounding the transaction. The trading activities of Dealers facilitate the exchange of Bitcoins with fiat currencies by taking the opposite side of the trade but otherwise do not have any noticeable long-term impact on the supply or demand of Bitcoins. On the supply side, Miners can still work to gradually expand the total number of Bitcoins, reducing its valuation in the process at least until the maximum cap of 21 million Bitcoins is reached.

It would be interesting to actually substitute Bitcoin statistics into the formula and to conduct an empirical study of Bitcoin valuation based on the metrics suggested in the above. The caveat here is to not let the denominator term MV easily collapse into just the estimated Bitcoins transaction volume, as it would then make the equation of exchange trivially true almost by definition (since the numerator Q is just fiat money transaction volume!). The real challenge is in finding separate measurements (or proxies) for M and V that is useful from a Bitcoin valuation perspective. If anyone is interested in conducting such an empirical study we would love to hear about it.

Transported back to our real world on planet Earth, we can now more clearly see that our foreign exchange market is similarly comprised of market participants with identifiable roles: (i) commercial companies, especially multi-national companies, which have natural interests in foreign exchange through their payments for cross-border flow of goods and services, as well as foreign direct investments, and are thus the primary Users of foreign exchange; (ii) banks, financial firms, traders and other speculators playing the role of Dealers in foreign exchange; and (iii) money-printing central banks who are both the Miners and the Hoarders of significant foreign exchange reserves. These participants interact through a number of interconnected marketplaces in New York, London, Tokyo, Hong Kong, and Singapore that together form the backbone of our modern decentralized foreign exchange market.

“You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete.”

References:

- Pacia, Chris (2014, February 8). Bitcoin Explained Like You’re Five: Part 5 – Macroeconomics. Retrieved from: https://chrispacia.wordpress.com/2014/02/08/bitcoin-explained-like-youre-five-part-5-macroeconomics/

- Wang, Joseph Chen-Yu (2014, February 11). A Simple Macroeconomic Model of Bitcoin. Retrieved from: http://ssrn.com/abstract=2394024 or http://dx.doi.org/10.2139/ssrn.2394024

- Ciaian, Pavel and Rajcaniova, Miroslava and Kancs, d’Artis (2014). The Economics of BitCoin Price Formation. Arxiv. Retrieved from: http://arxiv.org/ftp/arxiv/papers/1405/1405.4498.pdf